$75,000 to $5,000,000

18 months

7%

Loan Type Bridge Loan, Commercial Loan, Construction Loan, DSCR Loan, Rehab Loan

Property Type 2-4 Units, Condo, Multi Family, SFR

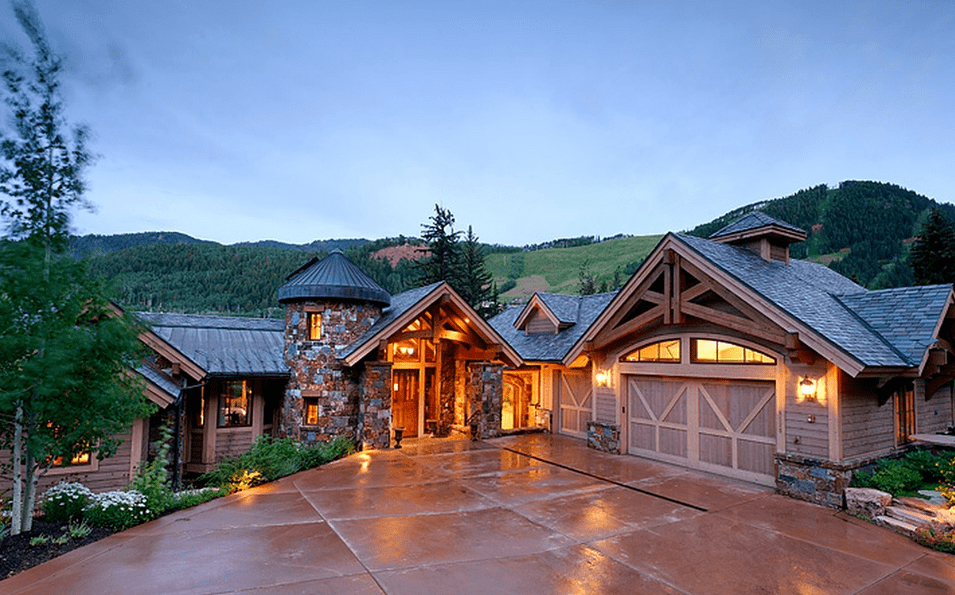

Colorado, renowned for its breathtaking landscapes, outdoor recreational opportunities, and vibrant cities, presents an enticing real estate market for long-term rental investors. With a combination of strong economic growth and a high quality of life, Colorado has captured the attention of individuals seeking both stable income and long-term investment potential. When evaluating the viability of long-term rental properties, one crucial metric to consider is the Debt Service Coverage Ratio (DSCR). This article delves into Colorado’s long-term rental real estate market, explores the concept of DSCR, and highlights key factors to consider when evaluating investment prospects.

The Debt Service Coverage Ratio (DSCR) serves as a vital financial metric used to assess whether an investment property can generate sufficient income to cover its debt obligations. Calculated by dividing the property’s net operating income (NOI) by its annual debt service (loan payments), the DSCR provides valuable insights into the property’s cash flow potential and risk level. Lenders and investors rely on the DSCR to evaluate the property’s ability to meet its financial obligations and generate favorable returns.

Rental Income Potential: Evaluate the rental income potential of a property by considering factors such as location, demand, neighborhood amenities, and proximity to employment centers. Research market rents and vacancy rates to ensure the property’s income aligns with local market trends.

While Colorado’s long-term rental market offers favorable prospects, it is important to consider potential challenges and risks:

Colorado’s long-term rental real estate market offers a unique combination of economic growth, population influx, and desirable locations, making it an appealing destination for real estate investors. Evaluating the Debt Service Coverage Ratio (DSCR) and considering factors such as rental income potential, operating expenses, financing options, and market dynamics are key to making informed investment decisions. While challenges exist, diligent research, local market knowledge, and engaging with real estate professionals will assist investors in capitalizing on Colorado’s thriving long-term rental market.

When it comes to real estate investment or business expansion, securing financing is often a crucial step. For many investors and entrepreneurs, Debt Service Coverage Ratio (DSCR) loans provide a pathway to realizing their goals. If you’re considering such a loan in Colorado, you might be wondering where the best opportunities lie. Here’s a rundown of the top 10 cities in the Centennial State where DSCR loans are particularly advantageous:

As the capital and largest city in Colorado, Denver boasts a dynamic economy and a thriving real estate market. From downtown skyscrapers to historic neighborhoods undergoing revitalization, Denver offers diverse opportunities for investment, making it a prime location for securing DSCR loans.

With a growing population and a strong military presence, Colorado Springs is a hub of economic activity. Its stable housing market and business-friendly environment make it an attractive destination for DSCR financing, especially for projects catering to the city’s diverse population.

Home to the University of Colorado and a burgeoning tech scene, Boulder is known for its innovation and entrepreneurial spirit. DSCR loans in Boulder often support projects in sectors like technology, healthcare, and renewable energy, tapping into the city’s vibrant ecosystem of startups and research institutions.

Located north of Denver, Fort Collins combines a high quality of life with a robust economy driven by education, healthcare, and manufacturing. DSCR loans in Fort Collins can fuel developments in both commercial and residential real estate, capitalizing on the city’s steady growth and economic stability.

As one of the largest suburbs of Denver, Aurora offers ample opportunities for DSCR financing. Its diverse economy, which includes aerospace, healthcare, and logistics, provides a solid foundation for investment across various sectors, attracting developers and investors alike.

Situated west of Denver, Lakewood is a major suburban center with a strong real estate market. DSCR loans in Lakewood often support projects ranging from mixed-use developments to commercial ventures, leveraging the city’s strategic location and pro-business policies.

Named for its status as Colorado’s newest city, Centennial embodies growth and opportunity. With a business-friendly environment and a focus on innovation, Centennial is an ideal destination for DSCR loans, particularly for projects that contribute to the city’s economic diversification.

Characterized by its historic charm and vibrant community, Arvada offers a mix of residential and commercial opportunities for DSCR financing. Whether it’s revitalizing downtown districts or expanding industrial parks, Arvada’s strong market fundamentals make it a favorable location for investment.

Located north of Denver, Thornton is a rapidly growing city with a burgeoning economy. DSCR loans in Thornton can fuel projects in sectors such as retail, healthcare, and logistics, capitalizing on the city’s strategic location and expanding infrastructure.

Known for its agricultural heritage and energy industry, Greeley is a dynamic city with a diverse economy. DSCR loans in Greeley often support projects in agriculture, manufacturing, and energy, tapping into the city’s rich resources and entrepreneurial spirit.

In conclusion, Colorado offers a wealth of opportunities for obtaining DSCR loans, with each city presenting its own unique advantages. Whether you’re eyeing the vibrant urban landscape of Denver or the scenic beauty of Boulder, there’s no shortage of potential for investment and growth in the Centennial State. With the right financing in place, the possibilities are endless.

Are you a lender who wants a free or premium listing on LendDing? Get started today!

Or Contact Us if you have a loan inquiry or question.

AL | AK | AZ | AR| CA | CO | CT | DE| FL | GA | HI | ID | IL | IN | IA | KS| KY | LA | ME | MD | MA | MI| MN| MS | MO | MT | NE | NV | NH | NJ | NM | NY | NC | ND | OH | OK | OR | PA | RI | SC | SD | TN | TX | UT | VT | VA | WA | WV | WI | WY